Buying your first home is one of the biggest financial decisions you’ll make in your life. Where you choose to put down roots influences everything from your career, to your children’s education, to your hobbies and much more.

But when you look past the anxiety and the gauntlet of decisions that come with homebuying, you’re left with the excitement of having a parcel of land to call your own. The trick is knowing how to get to that point as painlessly as possible.

Step one? Learn as much as you can about the homebuying process before you begin your search. The more you know about what you’re getting yourself into, the fewer surprises you’ll encounter, and the smoother the process will feel.

To that end, we’ve put together an introductory handbook that goes through each phase of the homebuying process, step by step.

A few things to keep in mind first

Saving is key

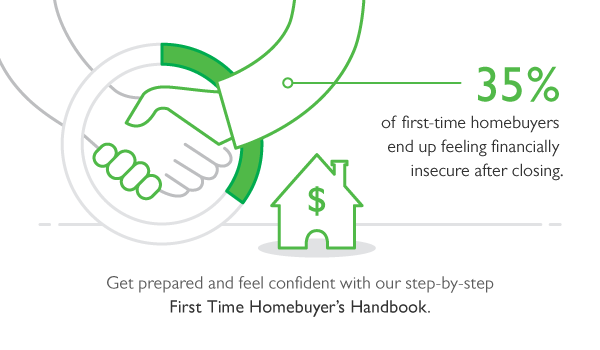

Nearly 35% of first-time homebuyers in 2019 said that they felt financially insecure after closing, according to research from NerdWallet. Ideally, by the time you make your down payment, you will have enough money saved to get you through a pinch such as an unplanned visit to the mechanic or the vet.

While putting more money down can reduce the amount you pay in the long run, you still have to be able to pay your mortgage and cover other costs of living. A few ways to start saving for a down payment include:

- Paying off your existing debts.

- Paying credit cards in full each month to avoid high interest rates.

- Making a monthly budget to help identify cost-cutting opportunities.

- Opening an interest-bearing savings account and contributing a portion of each paycheck to it.

- Putting most if not all of your tax refund each year into savings.

- Keeping a change jar (every penny counts!).

For financial-planning purposes, a general rule of thumb is to spend no more than 25% of your monthly income on your mortgage payment. If you anticipate that being a problem as you explore your mortgage options, you may need to reconsider the repayment terms.

Your first offer may not be your last

It’s not unusual to have to make multiple offers on the same property, or even make offers on multiple properties. This is just a reality that comes with shopping for a home, especially in highly competitive markets.

In fact, the first-time homebuyer in 2019 made an average of 3.8 offers before having one accepted – and many of those homebuyers exceeded their budget.

So, for your own sanity, mentally prep yourself for the possibility that your first-choice home might get away from you.

Otherwise, remember: Don’t offer more money than you feel comfortable with.

Get the free handbook

Without further ado, just click on the button below to get your copy of “The First-Time Homebuyer’s Handbook” and get your crash course in shopping for your first home.