Robocalls have become a frustrating and persistent problem for many people, with an estimated 46 billion robocalls made in the United States in 2020 alone. If you’re wondering why you’re getting so many robocalls and what you can do about them, read on.

Why do you get so many robocalls?

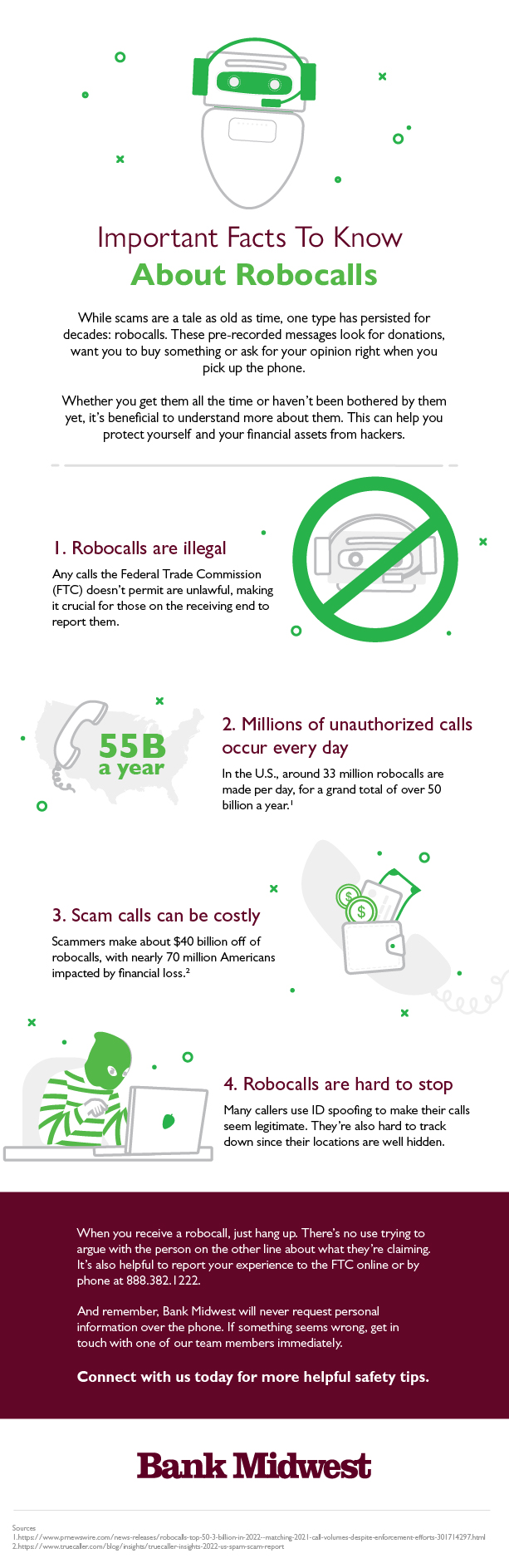

According to the Federal Trade Commission (FTC), companies using autodialers can send thousands of phone calls every minute for an incredibly low cost. Some robocalls, like an appointment reminder, flight status update, prescription refill reminder and other purely information messages, are permitted by the FTC.

But, if the recording is a solicitation being used without your written permission to receive it, the call is illegal. Scammers and telemarketers use robocalling technology to reach a large number of people quickly. They can use autodialing systems to call thousands of numbers in a short amount of time, making it more likely they will reach someone who will be enticed to give them money or personal information.

Additionally, outdated phone number registries, data breaches, and the ability of robocallers to spoof phone numbers mean that even individuals who have not given out their phone number may still receive robocalls.

Why are robocalls so prevalent and hard to stop?

Many fraudulent robocalls use ID “spoofing” to fake the caller ID information you see on the phone, so you think the call you’re receiving is from a company you know or already do business with. When it turns out the call is a scam, the robocallers, who have used internet technology to hide their location, are difficult to track down.

Robocalls are prevalent because they are cheap and easy to make. Unfortunately, some robocallers are located in foreign countries where U.S. authorities cannot prosecute them. Additionally, robocallers often use spoofed phone numbers, making it harder to track them down.

The Federal Communications Commission (FCC) and other regulatory organizations have attempted to crack down on robocalls by implementing regulations, creating a national do-not-call registry, requiring phone companies to implement call-blocking technology, and even issuing fines of millions of dollars to violators. However, these solutions are often ineffective in stopping the calls altogether.

What to do if you get a robocall

If you receive a robocall, there are a few things you can do to protect yourself.

First, don’t engage with the call. If you do answer and realize it is a robocall, hang up immediately. That’s it. Don’t try to argue your case with a fraudster. Engaging with the call could lead to the robocaller attempting to scam you or obtain personal information.

If you have been scammed by a robocaller or have received a particularly threatening call, you can take the following steps:

- Report your experience to the Federal Trade Commission (FTC) online or by phone at 1.888.382.1222.

- Contact your local law enforcement agency.

- Call Bank Midwest to take the necessary steps to protect your accounts. And remember, Bank Midwest will never ask you to give your account information, PIN, or password to us over the phone!

Technology that helps you remember your dental or hair appointment is great. But be wary and beware of calls that don’t sound like the trusted companies you know.

Robocalls are an unfortunate reality that many people have to deal with on a regular basis. While it may seem difficult to stop them altogether, there are steps you can take to protect yourself and avoid becoming a victim of a robocall scam.

Post updated. Originally published December 2013.